For those who are over the age of 55 and have mortgage free property or a small mortgage, now is the time to act to secure your financial future. Canadian Home Income Plan, also known as CHIP reverse mortgage manages home loans for seniors in Canada,. The CHIP reverse mortgage is offered by HomEquity Bank, a schedule 1 chartered bank. HomEquity Bank has been vetted by the federal government to provide this type of mortgage under their bank licence.

In today’s economy, mortgages are more difficult to manage, but keeping your finances in order and secure your future is quite possible. Here’s more on the CHIP reverse mortgage:

- If you are age 55 or over (and your spouse is as well) then you qualify for this program.

- As long as you or your spouse live in your home, you will never be required to make a mortgage payment. It is only after you move out of the residence that the payments begin.

- The money you receive from the CHIP reverse mortgage is not added to your taxable income and won’t affect your Guaranteed Income Supplement, your Old Age Security or any other benefits you receive.

- There are no restrictions on how you use the money from your loan.

- You do not give up ownership or control of your home.

- Your home equity continues to grow with your property appreciating in value.

- Unlike most mortgages, the CHIP mortgage is not a demand loan. This means that if the market value of the property goes down, the mortgage cannot be called in.

Leaving money to your family

One of the concerns about a CHIP reverse mortgage is that there will be no equity left for family once the home owner were to pass on. However, this is unlikely to be a factor with even a modest appreciation in real estate values over time.

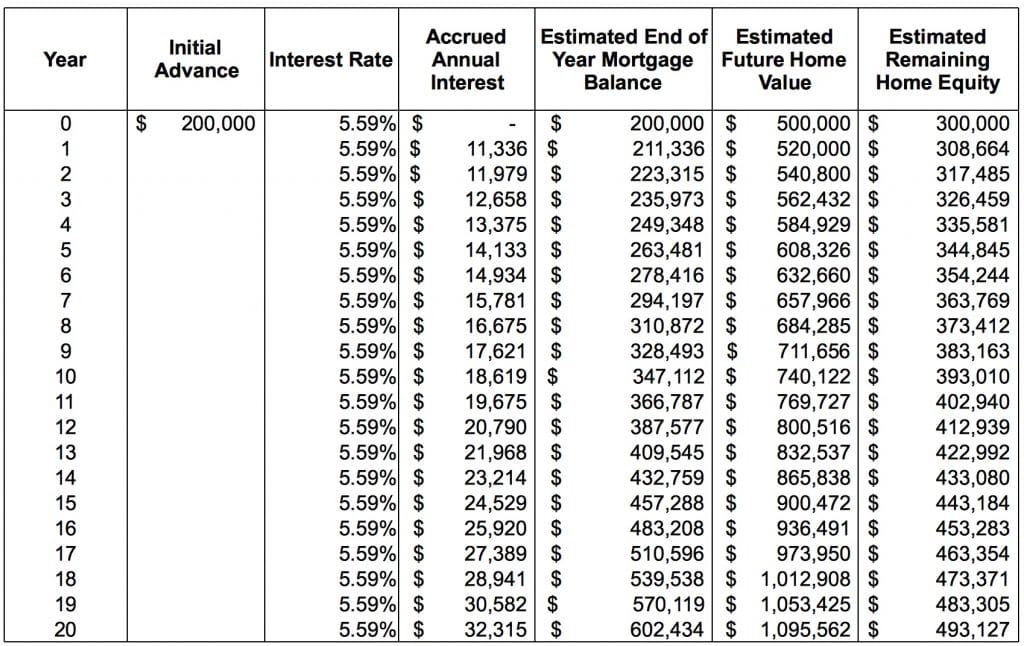

Below is an illustration of how the CHIP mortgage affects equity in your home. This example assumes a $200,000 mortgage on a $500,000 home, with an average appreciation in value of 4% and an interest rate of 5.59%. As you can see, the equity increases from $300,000 to $493,000 over the course of 20 years. The property equity still increased.

Furthermore, you have worked hard over the course of your lifetime to build up that equity in your home. If you need some of it in order to enjoy the rest of your life with, you should not feel bad about using it. I am also certain that family who love you want you to be comfortable and enjoy you life, and the CHIP reverse mortgage will also help provide them with peace of mind.

But the mortgage rate is soooooo high!

I hear this concern expressed at times, and it is understandable in the times of 2.49% interest rates to think that 5% is very high. However, there are reasons for this.

In all investments, the amount of risk that is taken influences the rate of return (i.e. a risky investment needs to provide a better return to compensate for the risk.) That is not to say that you or your home are risky investments, but it is all relative. Also, if there are benefits that are provided by the more costly option, the cost of those additional benefits are also built into the rate of return.

Here are some benefits of the CHIP reverse mortgage that the rate compensates for:

- Unlike most other mortgages, the CHIP cannot be called on by the bank at any time.

- Since you never have to make a mortgage payment, the balance accumulates while you have the CHIP, so the balance of the mortgage increases, rather than decreasing. Although your equity will generally increase under this arrangement, it is still an element of risk.

- There are no credit requirements and no income requirements.

- Unlike the chartered banks, the mortgage penalties are relatively small on this mortgage, and there are flexible provisions for paying out the mortgage at reduced or no penalty in the event of death or moving to a care facility.

- HomEquity Bank is one of the few mortgage lenders that will allow for a Power of Attorney to sign on behalf of the owner.

A real life example where a CHIP mortgage is beneficial

I was speaking with someone whose friend (who I also knew) wanted to buy a home. He wanted to purchase with all cash from the proceeds of the sale of his previous residence. He wanted to buy in one area, and that area was quite expensive, and he could not afford to buy anything he liked in that area. As such, he decided he would buy in another, less expensive area, 30 km away.

I suggested to this person that his friend contact me about the CHIP mortgage. It could give him the difference necessary for him to buy a home in the area he wanted to buy. When he told his friend about it, he would have NONE of it because he thought that it would eat up his equity.

He moved to the area 30 km away from where he wanted to buy, and last I heard was that he was not happy being there. Additionally, the past year has been INSANE for property appreciation, and the area he would have purchased with a CHIP reverse mortgage would have gotten a MUCH greater appreciation in value compared to the area he bought in, and the appreciation would have been on a much larger value home. Not taking the CHIP reverse mortgage cost him a lot of money!

If you are still reading this, then call me!

If you have made it all the way to the end of this page, this must be something that is of interest to you. There is no obligation on your part if you give me a call. I do many different types of mortgages, not just a CHIP, and if, after we sit down and analyze your situation, its not the best option for you, I can also provide other mortgage options. Call me, or fill out the form on the right side of the page and I will get right back to you!