What is a Tax Deductible Mortgage?

The Tax Deductible Mortgage is a financial structure that can help to pay your mortgage off years sooner and increase your wealth far faster than paying your mortgage off conventionally. It is also promoted primarily as a method to make your mortgage tax-deductible. I believe that while that is a sexy characterization of it, making that as the primary selling point of the structure is selling its benefits short. It is far more beneficial than that.

How does The Tax Deductible Mortgage work?

- You obtain a mortgage approval for a regular mortgage that also has a re-advanceable home equity line of credit (HELOC) component. Many mortgage lenders cannot re-advance your mortgage, but I do have access to a lender program that can do this. You can start with a HELOC that has just $1 available, but the more available room that you have in your HELOC to start, the faster that the process will be. We can discuss the details of your circumstances and how your best structure would be.

- You would then work with a financial planner or investment advisor on investments that qualify for interest on loans that fund such investments to be tax-deductible. These are typically interest or dividend-paying investments.

- When you make a regular mortgage payment on your fixed-rate loan, the principal portion of the loan will become available to borrow in your HELOC. When it becomes available, your investment advisor would then debit the HELOC and put your funds in the investment that you had arranged with them. This process happens month after month.

- When a qualifying investment has paid out a dividend, you apply it to pre-pay your regular fixed-rate mortgage, which would then become available on the HELOC and then re-invested. You would repeat this process every month.

This process results in having your mortgage effectively paid off years sooner than if the mortgage is paid conventionally with no extra cash out of your pocket. I have made a spreadsheet to model different scenarios. Keep in mind that no model will exactly replicate reality due to fluctuations in your investments, interest rates, etc. However, it is meant to model an overall average, and can effectively demonstrate the benefit of this program.

Tax Deductible Mortgage example

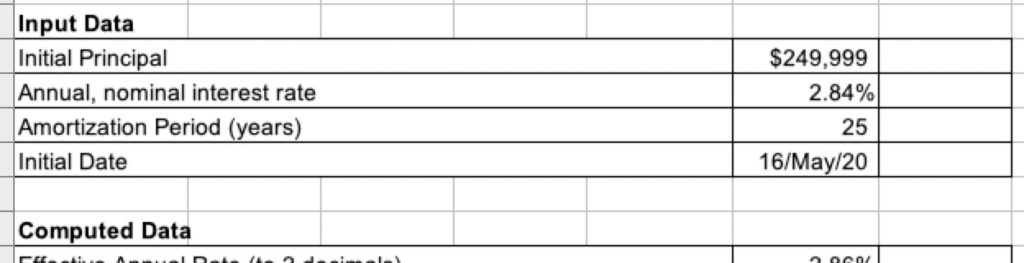

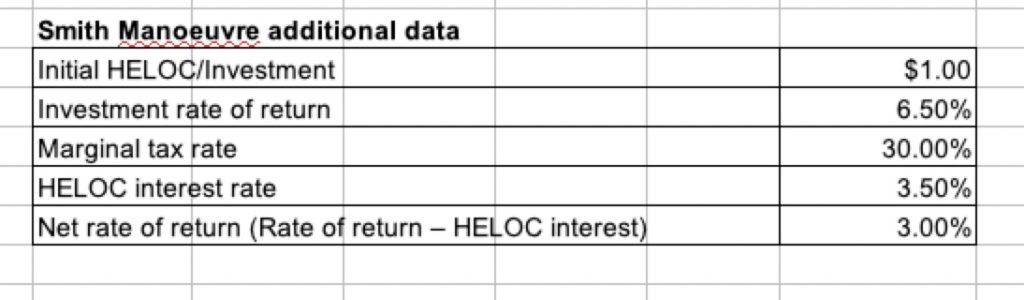

Here is the circumstances of this example mortgage:

In the case of a Tax Deductible Mortgage scenario, we assume the following additional information:

This scenario is about as conservative of a situation as you can get, as you are starting at 0. If there were an initial HELOC/Investment, then the process would happen much faster, and I believe for many people who look at this, it would be quite possible that they could start in an accelerated scenario. I also assumed that the return was net of any investment management fees.

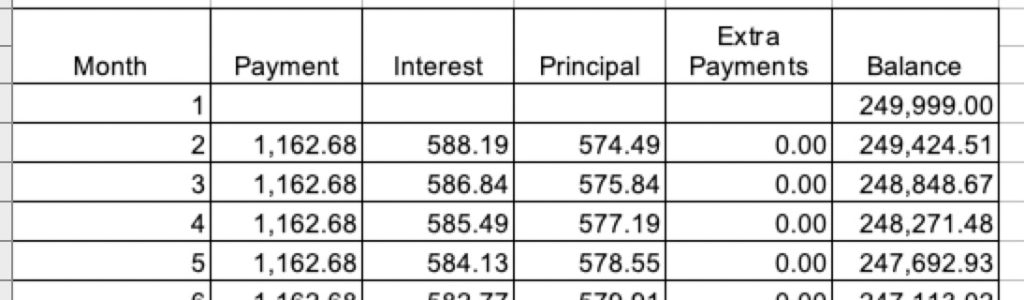

For the conventional mortgage, the table begins like this:

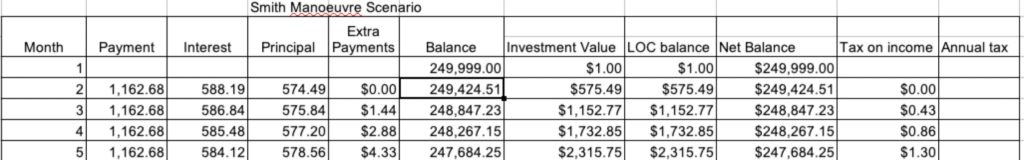

For the Tax Deductible Mortgage, here is how the table begins:

Note that I am adding up the tax due on the income generated and paying it by decreasing the investment on that month to cover the taxes owing on month 13 and every twelve months following. I am assuming a monthly dividend, and I am not factoring any dividend tax credit allowances or anything into the taxes payable. A quarterly dividend would alter the numbers slightly, but the model should still be accurate overall.

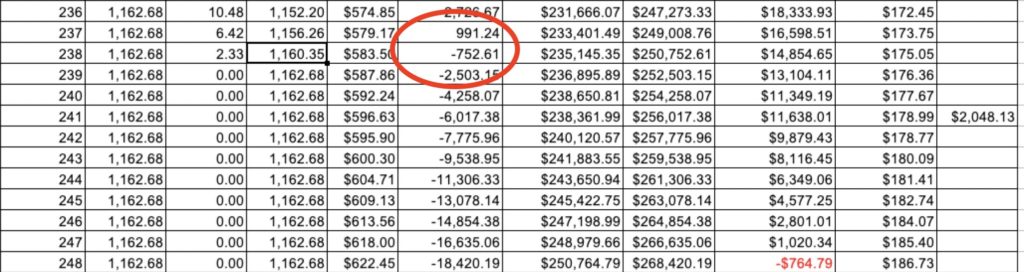

In the Tax Deductible Mortgage scenario, using the same numbers as a regular mortgage that would take 25 years of monthly payments to pay off, you would get to a fully “tax-deductible” mortgage level in just under 20 years, meaning NO MORE MONTHLY PAYMENTS:

Note that in this scenario, there is still a net balance. If you were to liquidate your investments to pay off the HELOC, but this is assuming you were to purchase an investment with no growth scenario (meaning the share price did not increase). I screenshotted the spreadsheet to month 248 to show the point where you would be equity positive, assuming you took the monthly payments plus the additional income and purchased investments with it.

Another factor that could improve the results would be if the property went up in value over time, and that allowed you to take out additional equity and add it to the HELOC and invest it. As an example, if your home went from $400,000 to $430,000 in 5 years, at the time of renewal you could request to qualify for an additional $19,500 on the HELOC which you would then put into investments and draw the dividends from. This would allow the process to accelerate.

Are there any downsides to this structure?

Overall, this structure is excellent for almost anyone who can qualify for the mortgage necessary to do this. There are a few things to keep in mind when doing this to ensure that CRA does not rule the structure to be offside. Still, it should be quite easy to follow, and you should have the advice of an accountant, financial planner and myself as a mortgage broker to help ensure that everything is set up and executed correctly. We can go through those items during a mortgage application review.

However, I will address one item that comes up in most people’s minds when they learn about this program. That question is, “Will CRA try to find a way to make this illegal?” or some variation thereof. In the past, some have speculated that CRA would consider a “tax dodge,” albeit a legal one and that CRA would not like it and find a way to watch those who did it.

My opinion on this, when thinking about it, is that such an idea is nonsense. On the contrary, you are paying taxes on the investments that you have legitimately purchased, and you are investing in the capital markets in some way, which is beneficial for the economy. The only potential issue that could arise could be if everyone did this. Canadian real estate would be highly leveraged, and that may concern the macro-economic bureaucrats in government who have made short-sighted and unfair policy decisions. However:

- Society is a long way off from having that kind of massive change that would cause the government to have concerns about this.

- In some form or fashion, this is already kind of built into the market. Businesspeople will refinance their homes to invest in their business, to purchase an investment, etc. The media will always talk about debt as a news story, and it is instinctive to view it negatively. However, the nature of the reporting is unbalanced without knowing what that borrowing is achieving. If you are borrowing to spend frivolously, then you are not getting value for your money (although you are helping the economy). If you are borrowing and investing, then not using your home for capital would hurt the economy if they were to make it more challenging to do so.

- You can also characterize the Tax Deductible Mortgage as a leveraged investment structure. Even when not using homes, people borrow for investment purposes every day. An RRSP loan is a loan for investment purposes, and people get them easily. Businesses buy a car for work with a vehicle loan and write off the vehicle and the interest on the loan. The vehicle is an asset, an investment in the business. The Tax Deductible Mortgage is just another application of the same principle.

What if I lose money on my investment?

An investment advisor is the best person to answer this question, but some people will be particularly conservative with their money. The only investment that they consider safe is a GIC, which by its very nature is a money-losing proposition (the reason why is outside of the scope of this article, but if you have that question during our work on a mortgage, I will explain to you at that time).

In the short term, your investments could indeed lose money. It is a paper loss unless you cash it in, but on paper, you could show a decline in the short term if you got the wrong investment at the wrong time. However, this is not a short term structure, and in the long run, every model of the market has shown that the average return is substantially positive. The TSX composite has, as of March 17, an average return of 6.51% over the last ten years, and the S&P 500 has an average return of 15.38%. I am confident that with sound financial management, the results that are in my spreadsheet example are possibly on the conservative side of what is possible.

How much can you save with the Tax Deductible Mortgage? Want to find out?

The Tax Deductible Mortgage is a structure that takes a bit of effort to understand, but it is so worthwhile. I designed the spreadsheet in order to show my clients the difference that it would make to their finances if they chose to do it. I am now providing this spreadsheet for FREE to every eligible client as part of their mortgage review process. Call me today, and after a brief discussion, we can look at taking the next steps down the road toward an approval for you and your family.